New Battlefield! The Global Competition Over "Circuit Boards" Heats Up

21st Century Business Herald

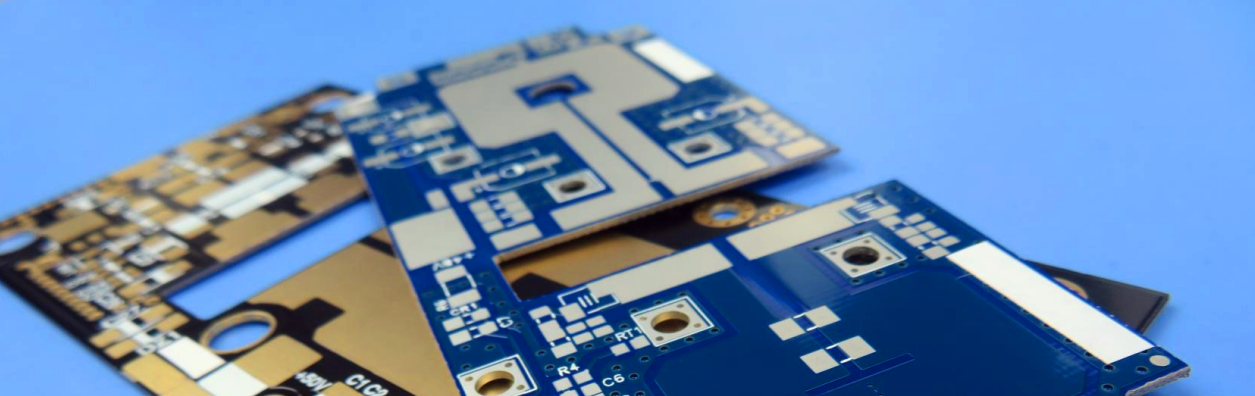

As Tesla’s Robotaxi prepares to hit the roads and smartphone AI assistants grow increasingly "smarter," the circuit boards behind them are undergoing a technological revolution. Since 2025, the PCB (Printed Circuit Board) industry has seen multiple growth drivers—from AI data centers to new energy vehicles, foldable phones to robotics—the upgrade of electronic devices is fueling a surge in PCB demand. Domestic manufacturers are rapidly expanding high-end production capacity, and a "circuit board revolution" is underway. Below is a summary of the industry’s key growth drivers.

1. AI Servers "Devour" Circuit Boards: Costs Triple per Board

Inside Nvidia’s AI server factory, the circuit boards are nothing like those in traditional computers—20+-layer "super PCBs" are densely packed with chips, with each board costing three times more than those in conventional servers. This is because AI training requires massive data transfers, pushing PCB layer counts from the traditional 8 layers to 20-30, with materials upgraded to high-speed, low-loss specialty substrates. Broadcom’s latest Tomahawk 6 chip boasts 102.4Tbps bandwidth, requiring even more precise PCB trace designs. Domestic supplier Shengyi Tech’s high-speed copper-clad laminates (CCL) have entered the supply chain, with prices five times higher than standard materials.

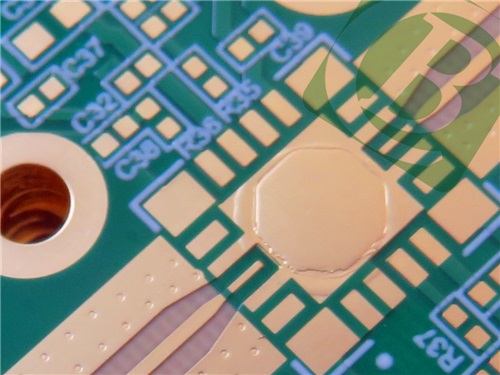

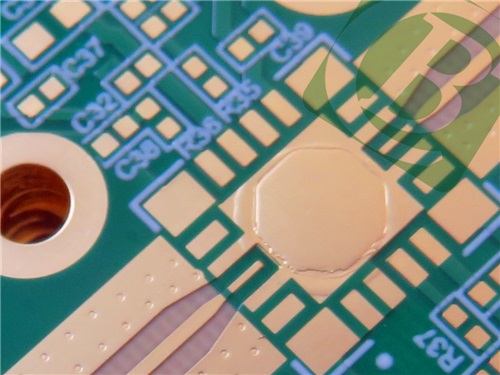

Our new 6-layer hybrid PCB, built with M6 High Speed PCB material and High Tg FR-4, perfectly fits into this high-speed data transfer trend. It features 4/4 mils minimum trace/space, 0.2mm minimum hole size, and a copper coin embedded in the center for enhanced performance. The Megtron 6 material offers exceptional dielectric properties (DK 3.4 at 1GHz, 0.002 dissipation factor) and supports 4-30 layer designs, while Isola 370HR provides high thermal performance and reliability, making it ideal for complex circuit requirements in AI servers.

Leading manufacturers like Shenghong Tech and Wus Printed Circuit already have AI server PCB orders backlogged until Q1 2026, with some running at full 24/7 capacity. Nvidia’s GB200 servers use 6-step 24-layer HDI PCBs, with each unit requiring five times the volume of traditional servers. Ping An Securities Research estimates that global high-layer (18+ layers) PCB output value will grow 41.7% in 2025.

2. Vehicle Electrification Doubles Automotive PCB Value

In BYD’s Blade Battery management system,12-layer flexible PCBs and 3OZ heavy copper boards form the core of its electric control system. Engineers at Jingwang Electronics note that the PCB value per new energy vehicle now reaches ¥1,500-2,000—double that of traditional ICE vehicles—while L2+ autonomous driving domain controllers require 16-layer HDI boards, pushing prices above ¥5,000. Tesla’s self-driving control boards use Any-Layer HDI technology with laser-drilled holes as small as 0.1mm. Domestic suppliers’market share has risen from 30% in 2023 to 45%. China Merchants Securities reports that in Q1 2025, domestic automotive PCB capacity utilization exceeded 95%, with 77GHz radar board lead times extending to 10 weeks.

Everbright Securities research shows the global automotive PCB market will reach $9.4 billion in 2025, driven by Tesla’s Robotaxi and mass production of 77GHz millimeter-wave radar boards.

3. Consumer Electronics "Compete" on Integration: Motherboard Shrinks 20%

Your next foldable phone may hide a "smarter" circuit board. The iPhone 16 Pro’s motherboard is 20.7% smaller than its predecessor yet packs more AI chips, thanks to Substrate-Like PCB (SLP) technology—laser drilling and stacking increase circuit density threefold. Apple supplier Avary Holdings is investing ¥5 billion to expand high-end HDI production, boosting SLP capacity by 50% at its Huai’an plant. Beyond phones, AI PCs are reshaping PCB demand. Laptops with AI chips require higher-layer PCBs for fast data processing, with Shengyi Electronics’advanced HDI boards entering Microsoft and Google’s supply chains. "AI PC PCB orders are growing 20% monthly," according to industry sources. China Merchants Securities notes that AI-driven upgrades are pushing HDI penetration in consumer electronics above 35%.

4. Robotics Industrialization Triggers Structural PCB Demand Surge

Unitree’s quadruped robot inspection system uses 10-layer EMI-resistant PCBs for real-time substation monitoring. Ubtech’s Walker S humanoid robot employs high-frequency PCBs in its joint drivers for zero-lag motion control. Robotics PCBs demand high-density layouts and extreme reliability, with companies like Unitree and Ubtech accelerating the shift to high-frequency, high-speed designs—unlocking long-term growth potential.

Industry Boom Continues as Analysts Foresee Strong Earnings Growth

China Merchants Securities projects a 5.2% CAGR for the global PCB market from 2024-2029, with AI servers, 800G switches, and robotics lifting industry gross margins by 3-5 percentage points. Everbright Securities highlights that the PCB sector is in a "dual-cycle" of technological advancement and domestic substitution. Leaders like Shenghong Tech and Shengyi Tech, with their capacity and R&D edge, are poised to break through in AI computing, automotive electronics, and robotics—extending the industry’s growth cycle through 2026.

Call Us Now !

Tel : +86 755 27374946

Call Us Now !

Tel : +86 755 27374946

Order Online Now !

Email : info@bichengpcb.com

Order Online Now !

Email : info@bichengpcb.com