CCL Industry Witnesses a Capacity Expansion Spree, Accelerating Localization Substitution of Core Materials

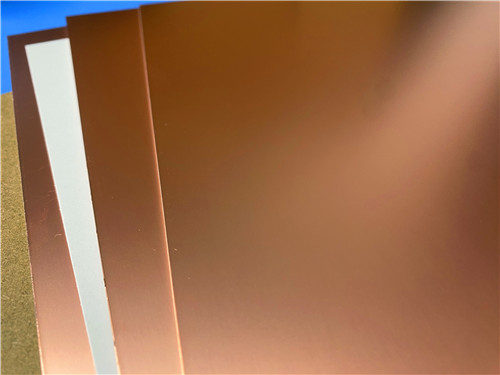

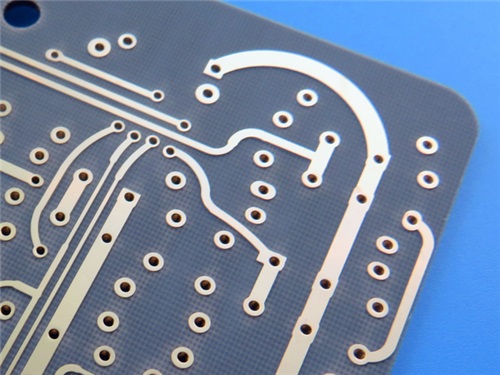

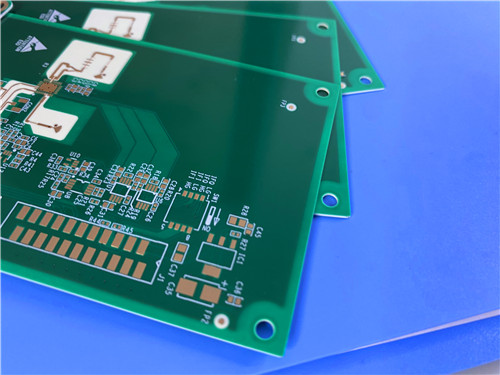

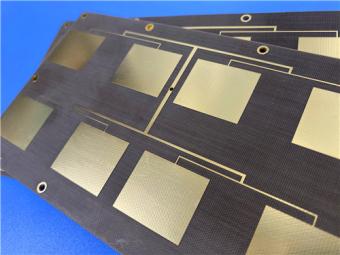

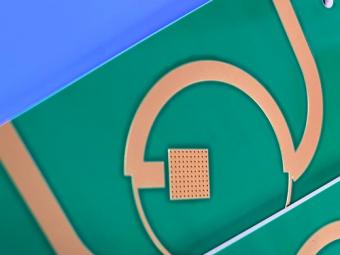

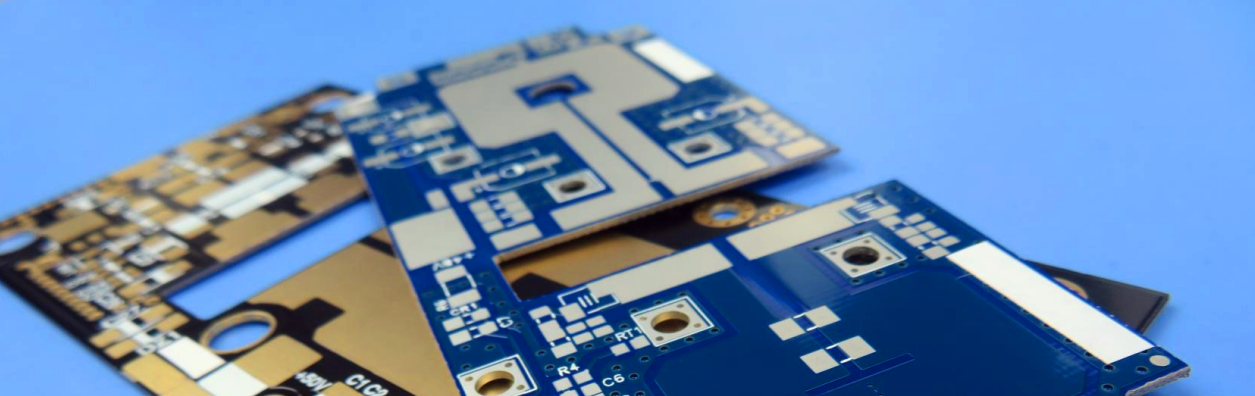

CCL Industry Witnesses a Capacity Expansion Spree, Accelerating Localization Substitution of Core Materials "Based on our recent insights, the copper-clad laminate (CCL) industry is entering a new phase of prosperity, with some enterprises operating non-stop even during the Spring Festival," a person in charge of a well-known domestic phenolic resin enterprise told the Securities Times reporter on January 25. "Amid the rise of China's domestic CCL industry, the localization substitution of core materials is expected to pick up speed." Enterprises Ramp Up Investment in High-performance CCL CCL is the primary application field of phenolic resin. The aforementioned phenolic resin enterprise interviewed by the reporter counts major CCL manufacturers among its downstream clients, including Taiwan Union Technology, Chin-Poon Industrial, Shengyi Technology (600183), Huazheng New Materials (603186), Kingboard Holdings (002636), and South Asia New Materials (688519). "Driven by the surging demand for AI servers, automotive electronics (885545) and optical communications, CCL enterprises are embracing a recovery," the person said. "We just completed a research tour at a CCL enterprise, which is quite optimistic about the market situation in 2026. It even plans to keep production running through the Spring Festival due to tight delivery schedules requested by clients." As a key upstream material for printed circuit boards (PCB, 884092), CCL is ultimately applied in communication equipment (881129), automotive electronics (885545), consumer electronics (881124), semiconductors (881121) and other sectors. Over the next 3-5 years, the growth of the PCB industry will be mainly driven by the dual engines of "AI computing infrastructure + intelligent automotive electronics (885545)". Meanwhile, advanced packaging (886009), edge-side AI hardware, high-frequency communications and other fields will bring structural growth opportunities, with the industry clearly trending toward high-end and high-value-added upgrading. Recently, the explosive demand for AI servers has led to a shortage of high-end raw materials. Resonac, the global leader in the CCL industry, has announced a comprehensive price hike of over 30% for CCL and other materials starting from March 2026. Boosted by the soaring demand for AI servers and new energy vehicles (850101), the global PCB market scale reached 88 billion US dollars in 2024. According to forecasts by consulting firm Prismark, the global PCB market output value will grow by approximately 6.8% in 2025 and maintain sustained growth in the coming years, reaching about 94.661 billion US dollars by 2029 with a compound annual growth rate (CAGR) of around 5.2%. In terms of global production capacity distribution, China has become the absolute leader, accounting for about 50% of the world's total PCB production capacity. The Pearl River Delta (Guangdong Province contributes 40% of ...

Call Us Now !

Tel : +86 755 27374946

Call Us Now !

Tel : +86 755 27374946

Order Online Now !

Email : info@bichengpcb.com

Order Online Now !

Email : info@bichengpcb.com