AI and Automotive Electronics Fuel PCB Industry Boom

As the global electronics industry accelerates its digital transformation, the printed circuit board (PCB) sector is experiencing an unprecedented growth spurt driven by AI computing and intelligent automotive innovation. October 2025 has witnessed remarkable milestones—from surging corporate earnings to technological breakthroughs—painting a vivid picture of an industry entering a high-value era. At Bicheng, we closely monitor these trends to deliver cutting-edge solutions to our global partners.

Demand Surge: AI and Automotive Electronics as Dual Engines

The third-quarter performance reports of leading PCB enterprises have underscored the industry's robust momentum. Shengyi Electronics, a key player in high-precision PCBs, announced a staggering 476% to 519% year-on-year growth in net profit for the first three quarters, with Q3 net profit soaring by over 501% sequentially . This explosive growth stems primarily from the rising demand for high-value PCB products in AI and automotive electronics. According to Prismark forecasts, global PCB market value is projected to reach $79.128 billion in 2025, representing a 7.6% year-on-year increase, with AI servers and new energy vehicles (NEVs) as the primary growth drivers .

AI computing has become a game-changer for PCB value escalation. The proliferation of AI inference servers—accounting for over 60% of global AI server shipments in 2025—has pushed PCB requirements to new heights. A single AI inference server now demands PCBs worth 1,200 to

1,500, a fivefold premium compared to standard servers . This surge is fueled by cloud giants' expanded capital expenditures: overseas cloud providers are ramping up data center construction, creating sustained demand for high-multilayer PCB, high-frequency PCBs .

The automotive sector is equally transformative. With China's NEV penetration exceeding 50% and L3 autonomous driving adoption surpassing 25%, the PCB content per vehicle has jumped from 6-8㎡in traditional cars to 18-25㎡in smart electric vehicles, with value surging from 1,500 to over7,500 . ADAS radar systems, 800V high-voltage platforms, and intelligent cockpits are driving demand for specialized PCBs: The automotive-grade HDI boards, certified to AEC-Q100 Grade 0 (withstanding -40℃to 150℃), have become preferred choices for tier-one suppliers like Bosch and Continental .

Technological Leap: High-Value Innovation Takes Center Stage

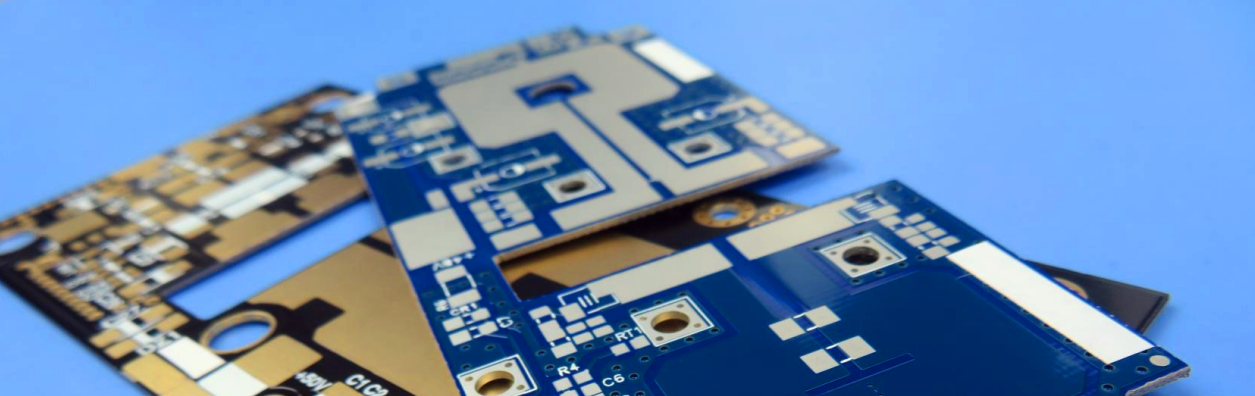

October 2025 has seen significant advancements in PCB technology, with high-density and multifunctional designs becoming industry standards. HDI (High-Density Interconnect) technology, featuring microvias (<50µm) and fine line widths/spacings (<40µm), is now ubiquitous in AI chips and 5G base stations . At Bicheng, we have enhanced our Any-layer HDI production capacity, reducing signal transmission loss to 0.002dB/cm@10GHz using modified polyimide substrates—critical for satellite communication and millimeter-wave radar applications .

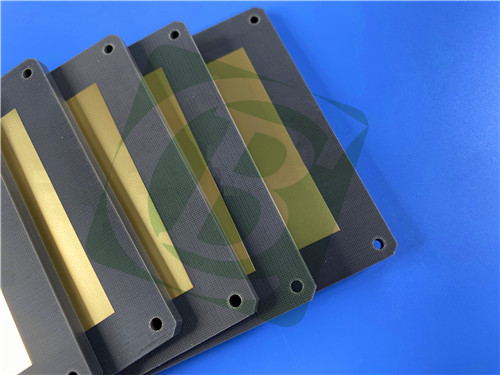

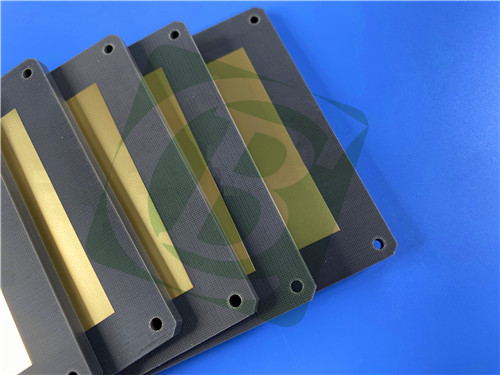

Material innovation is another key breakthrough. Low-Dk (≤3.0) and low-Df (<0.002) materials like liquid crystal polymer (LCP) are enabling 5G millimeter-wave (28GHz+) communication, while ceramic-filled composites have boosted thermal conductivity to 5W/m·K, addressing heat management challenges in power electronics . This month, we launched our F4BTMS PCB series—an upgraded iteration of the F4BTM PCB line featuring breakthrough material formulation. By integrating ultra-fine glass fiber cloth with uniformly distributed nano-ceramics and polytetrafluoroethylene (PTFE) resin, the series minimizes glass fiber-induced electromagnetic interference, reducing dielectric loss and enhancing dimensional stability . The flag ship F4BTMS255 PCB variant, used in our 2-layer rigid PCBs (35μm copper layers, 1.524mm core), delivers exceptional performance: Dk of 2.55±0.04@10GHz, Df as low as 0.0012@10GHz, and CTE stability from -55℃to 288℃.

Standard-equipped RTF low-roughness copper foil further reduces conductor loss while ensuring strong peel strength, aligning with global high-frequency material standards . As a high-reliability alternative to imported counterparts, it serves aerospace equipment, military radar, and satellite communication systems—complementing our modified polyimide substrates for satellite and millimeter-wave applications .

We have also embraced eco-friendly solutions: our halogen-free PCBs, using phosphorus-nitrogen flame retardants, reduce toxic emissions by 70% and comply with EU RoHS 2.0 standards, aligning with global sustainability goals .

Embedded component technology is reshaping design possibilities. By embedding resistors and capacitors into PCB inner layers, we save 30% of surface space and shorten high-frequency signal paths by 15%—a critical advantage for compact AR/VR devices and medical implants . This innovation has attracted partnerships with leading consumer electronics brands, who value our ability to integrate functionality with miniaturization.

Global Landscape: China's Dominance and Adaptive Strategies

China's PCB industry has solidified its global leadership, with output accounting for 75.2% of the world's total in 2025—up from 72.3% in 2024 . In high-end segments (8-layer+ PCBs, HDI, packaging substrates), China's capacity share has surged to over 95%, breaking the long-standing monopoly of Japanese and Taiwanese manufacturers . This dominance stems from "technology + cost" dual advantages: engineers have mastered 2.5D/3D packaging substrates and 800G switch PCBs with yields exceeding 90%, while labor costs remain 1/3 to 1/4 of those in the U.S. and Taiwan .

Notably, China's PCB exports have demonstrated remarkable resilience amid trade tensions. From January to September 2025, U.S.-bound PCB shipments grew by 30% year-on-year, with high-value products accounting for 55% of exports—up from 45% in 2024 . This resilience reflects global market reliance on Chinese supply chains: giants like Tesla and NVIDIA have adopted "volume-locked" procurement strategies, securing our production capacity 8-10 months in advance . At Bicheng, we have further strengthened this advantage by obtaining UL, IPC-6013DA, and ISO 10993 certifications, ensuring seamless access to North American, European, and medical device markets.

To mitigate geopolitical risks, Chinese PCB enterprises are pursuing global capacity layout. Following industry leaders like Hudian Electronics (Thailand plant) and Shenghong Technology (Mexico plant expansion).

The PCB industry's growth story in October 2025 is one of transformation—driven by AI, reshaped by automotive innovation, and led by Chinese technological breakthroughs. At Bicheng, we are to be at the forefront of this revolution, partnering with our global clients to turn intelligent ideas into tangible reality. As demand for high-value, reliable PCBs continues to soar, we remain committed to delivering excellence in every circuit we produce.

Call Us Now !

Tel : +86 755 27374946

Call Us Now !

Tel : +86 755 27374946

Order Online Now !

Email : info@bichengpcb.com

Order Online Now !

Email : info@bichengpcb.com