NEV & IIoT Dual Drive: PCB Industry Enters Specialized Growth Phase

The global PCB market has witnessed a pivotal shift over the past two months: the "specialized segment"—led by new energy vehicle (NEV) on-board PCBs and industrial IoT (IIoT) ruggedized PCBs—has emerged as the fastest-growing engine, outpacing even the high-profile AI server PCB sector in regional demand diversity. With Q4 2025 data now available, this article unpacks how NEV electrification and industrial digitalization are reshaping PCB requirements, and the tailored solutions driving value for global partners across automotive and industrial sectors.

NEV Electrification: On-Board PCB Demand Hits Record High

October-November 2025 marked a milestone for the global NEV industry: the International Energy Agency (IEA) reported that NEV sales accounted for 38% of global new car sales in Q4, up 7 percentage points year-on-year. This surge has directly fueled demand for high-reliability on-board PCBs, with three key segments leading growth:

Battery Management System (BMS) PCBs: As NEV battery capacities expand to 150kWh+, BMS requires PCBs with 12-20 layers, thick copper (3oz+), and extreme temperature resistance (-40°C to 125°C). According to CITIC Securities, the global BMS PCB market size will reach $8.2 billion in 2025, with a 45% Q4 growth rate. Key requirements include high-temperature resin (Tg≥180°C) and laser direct imaging (LDI) processes to ensure stability under harsh operating conditions.

Automotive Radar PCBs: The adoption of 4D imaging radar (for autonomous driving L3+) has driven demand forHDI PCBs with 8-12 layers and ultra-low loss (Df≤0.003 at 28GHz). In November, Tesla announced it would equip all 2026 Model Y vehicles with 4D radar, creating an immediate need for 100,000+ radar PCBs monthly. Market demand centers on boards with 50μm line width/spacing, optimized for high-frequency signal transmission.

In-Vehicle Infotainment (IVI) PCBs: The shift to 8K touchscreens and multi-display systems requires PCBs with high-speed signal transmission (10Gbps+). Southeast Asian NEV startups and established automakers alike are ramping up orders for 6-layer IVI PCBs, reflecting strong growth in emerging and mature NEV markets.

IIoT Digitalization: Ruggedized PCBs Conquer Industrial Environments

While NEV demand grabs headlines, IIoT’s expansion into harsh industrial settings (mining, oil & gas, smart manufacturing) is driving a boom in "ruggedized PCBs." Key trends from Oct-Nov 2025 include:

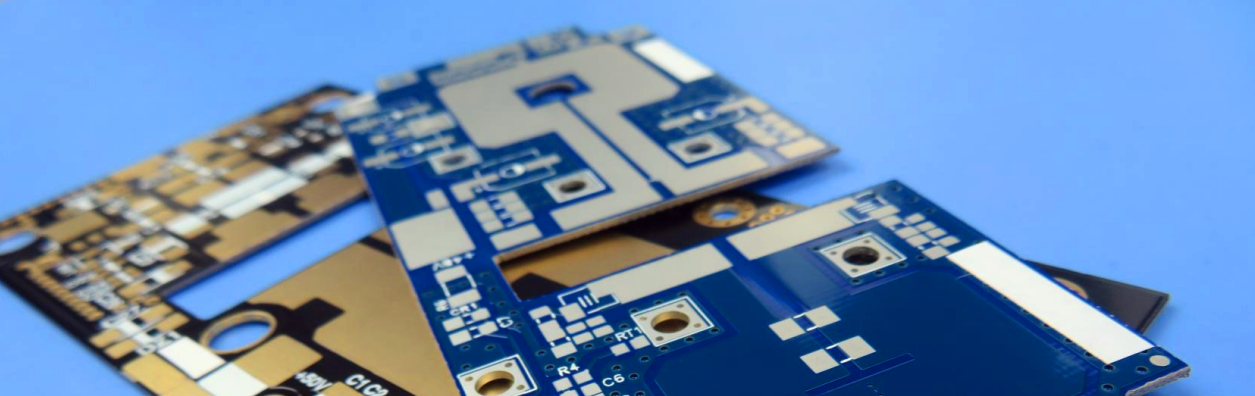

Environmental Resistance Requirements: Industrial PCBs now need to withstand corrosion, vibration (up to 500Hz), and extreme voltages (1000V+). In November, Siemens released its new industrial control system (S7-1500 Advanced), specifying PCBs with IP67 protection and tin-nickel plating. Market solutions leverage immersion silver (ImAg) surface finishes and reinforced base materials to meet thesestrict standards.

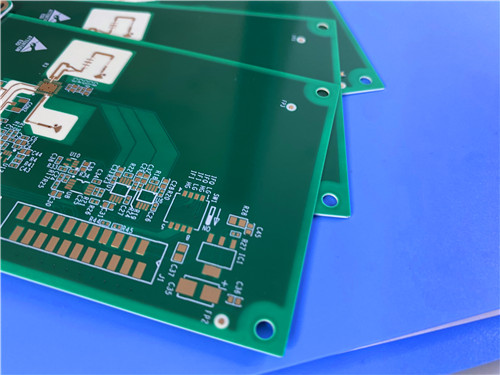

Edge Computing Integration: IIoT edge devices (e.g., smart sensors, real-time monitoring controllers) demand compact, high-density PCBs with stable high-frequency performance. Prismark data shows that edge computing PCBs (6-10 layers with microvias) will grow at a 32% CAGR from 2025-2030. Addressing this need, an industry-leading 6-layer rigid PCB has recently entered the market, tailored for edge computing and radar applications: its stackup features Rogers RO4350B (0.102mm) and S1000-2M (0.254mm) core materials, paired with 35μm copper layers and 0.254mm prepreg (1080 RC63%+7628 43%).RO4350B high frequency PCB delivers ultra-low loss (Df=0.0037 at 10GHz), high Tg (>280°C), and copper-matching CTE (X:10ppm/°C, Y:12ppm/°C) for dimensional stability, while S1000-2M ensures low Z-axis CTE and lead-free compatibility. This solution has been adopted by smart factory providers, reducing device size by 25% while improving heat dissipation and signal integrity by 30%.

Regional Demand Surge: Southeast Asia’s manufacturing renaissance (led by Vietnam, Malaysia) is a key driver, with orders for industrial control PCBs from regional semiconductor packaging firms soaring 220% in Q4 compared to Q3. This reflects the region’s shift from low-cost assembly to high-value manufacturing, creating new opportunities for specialized PCBs.

Supply Chain Challenges: Material Specialization & Regionalization

The rise of NEV and IIoT PCBs has introduced new supply chain complexities:

Specialized Material Shortages:High-temperature FR-4 (Tg≥180°C) and thick copper foil (3oz+) are in tight supply, with lead times extending to 16 weeks (up from 8 weeks in 2024). Leading suppliers have secured long-term agreements with material providers (e.g., Toray for high-Tg resin, Iljin Materials for thick copper foil) to ensure stable access.

Regionalization of Production: To avoid geopolitical risks and shorten delivery times, automakers are demanding "local-for-local" supply chains. Regional manufacturing hubs in Southeast Asia and planned facilities in North America are cutting delivery times to European and North American clients by 40% compared to long-haul shipping.

Certification Barriers: Automotive PCBs require strict IATF 16949 and AEC-Q200 certifications, while industrial PCBs need ISO 16750 compliance. Market leaders have invested heavily in meeting these standards, enabling access to high-barrier markets.

Market Solutions: Delivering Value in Specialized Segments

To capitalize on NEV and IIoT growth, the industry is prioritizing three core strategies:

Streamlined Certification & Testing: Integrated in-house testing (thermal cycling, vibration testing) reduces reliance on third-party labs, cutting certification time for automotive clients by 50% and accelerating sample delivery to 2 weeks vs. the industry average of 4 weeks.

Customization for Targeted Applications: Specialized design teams collaborate with clients to optimize PCB solutions—including tailored versions of the new 6-layer hybrid PCB. For mining equipment, this involves enhancing corrosion resistance (via polyimide overlays) and boosting heat resistance, extending product lifespan in harsh environments from 2 years to 5 years. The PCB’s compatibility with millimeter-wave and radar systems also makes it suitable for commercial airline broadband antennas and industrial guidance systems, opening cross-sector opportunities.

Sustainable Sourcing for ESG Compliance: European and North American clients increasingly require PCBs made with recycled materials. Market offerings now incorporate 20% recycled copper foil (including in the new 6-layer model) and 30% recycled glass fiber in base materials, helping clients meet EU’s Circular Economy Action Plan (CEAP) targets.

Conclusion: The Era of Specialized PCBs Is Here

Q4 2025 has proven that NEV and IIoT are long-term pillars of the PCB industry. Unlike the AI server segment, concentrated in a few tech hubs, NEV and IIoT demand spans Europe, Southeast Asia, North America, and emerging markets—creating a diversified and resilient growth path.

The market’s future lies in specialized solutions that balance performance, reliability, and regional accessibility. Innovations like the 6-layer rigid PCB for edge computing and radar applications are setting new standards for adaptability across automotive and industrial sectors. For global partners scaling NEV production or innovating in IIoT, accessing these tailored, high-performance PCB solutions is key to unlocking success in the specialized growth era.

Connect with trusted supply chain partners to explore customized PCB solutions aligned with your industry needs.

Call Us Now !

Tel : +86 755 27374946

Call Us Now !

Tel : +86 755 27374946

Order Online Now !

Email : info@bichengpcb.com

Order Online Now !

Email : info@bichengpcb.com