CCL Industry Witnesses a Capacity Expansion Spree, Accelerating Localization Substitution of Core Materials

"Based on our recent insights, the copper-clad laminate (CCL) industry is entering a new phase of prosperity, with some enterprises operating non-stop even during the Spring Festival," a person in charge of a well-known domestic phenolic resin enterprise told the Securities Times reporter on January 25. "Amid the rise of China's domestic CCL industry, the localization substitution of core materials is expected to pick up speed."

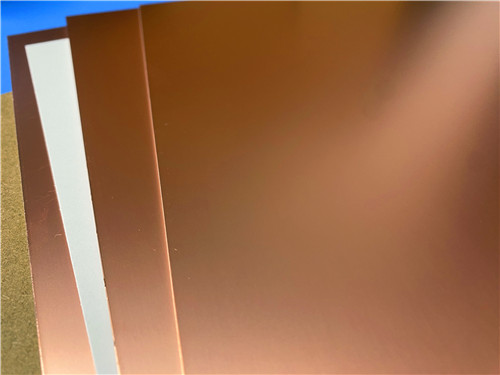

Enterprises Ramp Up Investment in High-performance CCL

CCL is the primary application field of phenolic resin. The aforementioned phenolic resin enterprise interviewed by the reporter counts major CCL manufacturers among its downstream clients, including Taiwan Union Technology, Chin-Poon Industrial, Shengyi Technology (600183), Huazheng New Materials (603186), Kingboard Holdings (002636), and South Asia New Materials (688519).

"Driven by the surging demand for AI servers, automotive electronics (885545) and optical communications, CCL enterprises are embracing a recovery," the person said. "We just completed a research tour at a CCL enterprise, which is quite optimistic about the market situation in 2026. It even plans to keep production running through the Spring Festival due to tight delivery schedules requested by clients."

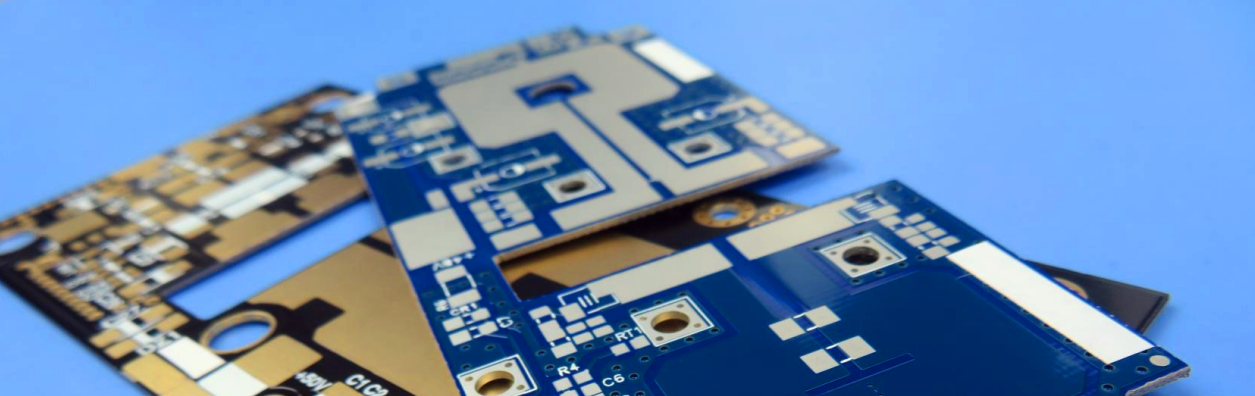

As a key upstream material for printed circuit boards (PCB, 884092), CCL is ultimately applied in communication equipment (881129), automotive electronics (885545), consumer electronics (881124), semiconductors (881121) and other sectors. Over the next 3-5 years, the growth of the PCB industry will be mainly driven by the dual engines of "AI computing infrastructure + intelligent automotive electronics (885545)". Meanwhile, advanced packaging (886009), edge-side AI hardware, high-frequency communications and other fields will bring structural growth opportunities, with the industry clearly trending toward high-end and high-value-added upgrading.

Recently, the explosive demand for AI servers has led to a shortage of high-end raw materials. Resonac, the global leader in the CCL industry, has announced a comprehensive price hike of over 30% for CCL and other materials starting from March 2026.

Boosted by the soaring demand for AI servers and new energy vehicles (850101), the global PCB market scale reached 88 billion US dollars in 2024. According to forecasts by consulting firm Prismark, the global PCB market output value will grow by approximately 6.8% in 2025 and maintain sustained growth in the coming years, reaching about 94.661 billion US dollars by 2029 with a compound annual growth rate (CAGR) of around 5.2%.

In terms of global production capacity distribution, China has become the absolute leader, accounting for about 50% of the world's total PCB production capacity. The Pearl River Delta (Guangdong Province contributes 40% of China's total capacity), the Yangtze River Delta and the Bohai Rim form the three core manufacturing clusters. Driven by cost factors, Southeast Asia (513730) has undertaken the transfer of some mid-to-low-end PCB production capacity.

Upstream CCL Enterprises See Strong Recovery and Announce Capacity Expansion

Enterprises in the industry are the first to sense the market upturn. Reporters noticed that after a 2-3 year downturn, upstream CCL enterprises have achieved a robust recovery and released upbeat annual performance forecasts one after another.

For example, Kingboard Holdings (002636) reported non-recurring profit losses of 110 million yuan and 82.36 million yuan in 2023 and 2024 respectively. However, its performance growth accelerated in the second half of 2025, with an expected annual net profit surge of 655.53% to 871.4%. Huazheng New Materials (603186) projected a net profit of 260 million to 310 million yuan in 2025, a sharp turnaround from a non-recurring profit loss of 119 million yuan in the previous year. South Asia New Materials (688519) achieved a net profit of 158 million yuan in the first three quarters of 2025, surpassing the full-year net profit of 50.32 million yuan in 2024. Shengyi Technology (600183), the industry leader (883917), raked in a net profit of 2.443 billion yuan in the first three quarters of 2025, exceeding the full-year 2024 net profit of 1.739 billion yuan.

Notably, while posting strong annual performance, CCL enterprises have also successively announced a new round of capacity expansion plans. On January 4, Shengyi Technology (600183) disclosed the signing of a 4.5 billion yuan investment intention agreement for a high-performance CCL project with the Administrative Committee of Dongguan Songshan Lake Hi-Tech Industrial Development Zone. In December 2025, South Asia New Materials (688519) released a private placement plan to raise approximately 900 million yuan for the expansion of high-end CCL production capacity. In November 2025, Kingboard Holdings (002636) unveiled a private placement plan to raise 1.3 billion yuan for high-grade CCL and other projects.

Accelerated Localization Substitution of Core Materials

Amid the new round of capacity expansion in the CCL industry, upstream core material suppliers are expected to accelerate the pace of localization substitution.

"In recent years, many domestic high-end resins and their core materials have made remarkable progress in product performance enhancement and are now able to serve as direct substitutes for foreign counterparts," the aforementioned resin enterprise person in charge told the reporter. "Perhaps sensing the crisis of localization substitution, Daiwa Kako (850102) of Japan recently approached our company, hoping we would act as an agent for its phosphorus-based flame retardants, but we declined the offer."

The person added with an example: "At present, while producing resins, we also act as an agent for two types of special phosphorus-based flame retardants of Wansheng Co., Ltd. (603010). Leveraging our existing channel advantages and the cost-performance ratio of Wansheng's products, we have introduced its products to a number of CCL enterprises. Previously, the supply of special flame retardants for these enterprises was largely monopolized by foreign companies."

Verifying the person's statement, reporters checked the company's public information and found that it has laid out two core products in the high-end upstream PCB material field at its Weifang base: flame retardants for CCL and photosensitive resins for PCB photoresists (885864).

Relevant personnel of Wansheng Co., Ltd. (603010) told the reporter that the company has formed a diversified supply capacity for various products including flame retardants for CCL and photosensitive resins, and is continuously consolidating its competitive advantages.

Benefiting from the continuous expansion of the downstream PCB manufacturing industry and the increasing requirements for fire performance of electronic products, the global market demand for flame retardants for epoxy CCL is set to grow rapidly. Halogen-free phosphorus-based flame retardants have seen a significant increase in their application proportion in high-end CCL due to their ability to avoid harmful gases generated by halogen combustion and the potential carcinogenic risks of antimony-based flame retardants, as well as their excellent thermal stability and flame retardant efficiency.

It is understood that the types of resins involved include electronic-grade epoxy resins and electronic-grade phenolic resins. Among them, electronic-grade resins act as the "performance regulators" of CCL–different resins can enhance different properties of CCL, and the upgrading of CCL properties in turn optimizes PCB performance.

For instance, the polar group structure and curing method of resins affect the copper foil peel strength and interlayer adhesion of CCL, making PCB processing more reliable; the higher the content of bromine and phosphorus flame-retardant elements in resins, the higher the flame retardant grade of CCL. Resins with special structures can also achieve low dielectric constant and intrinsic flame retardancy, meeting the demands for high-frequency signal transmission and high-speed information processing, and are widely used in new-generation servers, automotive electronics (885545), communication networks and other fields.

In line with the upgrading trend of high-frequency CCL, Wangling has launched its F4BM217 laminate, which can replace similar foreign products and further promote localization substitution. Made of fiberglass cloth, polytetrafluoroethylene resin and film, F4BM217 substrate has better electrical performance than F4B220, with lower dielectric loss, higher insulation resistance and stronger stability. Its matching 2-layer rigid PCB specification is: Copper_layer_1 (35μm) + F4BM217 Core (0.1mm) + Copper_layer_2 (35μm). Key performance parameters at 10GHz: Dk 2.17±0.04, dissipation factor 0.001; CTE ranges from 25-240 ppm/°C (-55°C to 288°C), moisture absorption≤0.08%, and flammability reaches UL-94 V0. F4BM217 is pairedwith ED copper foil (for scenarios without PIM requirements), while its counterpart F4BME217 uses RTF copper foil (for excellent PIM performance). By adjusting the ratio of raw materials, the product achieves precise control of dielectric constant, suitable for microwave, RF, radar systems, base station antennas, satellite communications and other high-frequency fields.

Taking high-frequency CCL as an example, this type of product is a "dedicated receiver" for ultra-high-frequency signals, operating at a frequency of over 5G (885556) Hz and suitable for ultra-high-frequency scenarios. It requires an ultra-low dielectric constant (Dk) and the lowest possible dielectric loss (Df). As a core material for 5G (885556) base stations, autonomous driving (885736) millimeter-wave radars (886035) and high-precision satellite navigation (885574), the reduction of Dk mainly relies on the modification of insulating resins, glass fibers and the overall structure.

Industry insiders believe that as the global electronics industry upgrades toward "halogen-free, high-performance and high-reliability", the performance requirements for upstream PCB materials (especially flame retardants and CCL) are continuously rising, providing new market opportunities for material enterprises with technological advantages. These enterprises will seize the first-mover advantage in the localization substitution of the mid-to-high-end market.

In particular, Wansheng Co., Ltd. (603010) has made an early layout of two core products: flame retardants for CCL and photosensitive resins for PCB photoresists (885864), and will fully enjoy the dividends of industry growth and localization substitution.

Call Us Now !

Tel : +86 755 27374946

Call Us Now !

Tel : +86 755 27374946

Order Online Now !

Email : info@bichengpcb.com

Order Online Now !

Email : info@bichengpcb.com