Current Status of the High-Frequency Copper Clad Laminate Industry

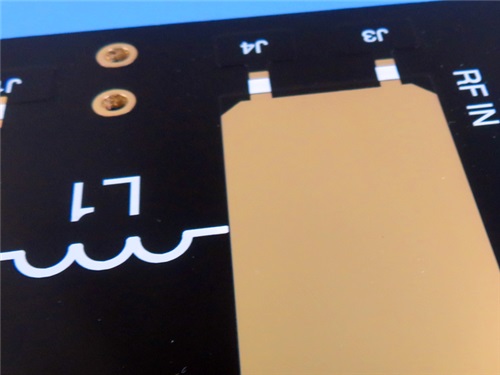

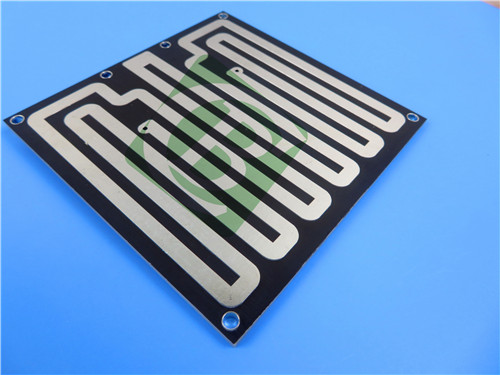

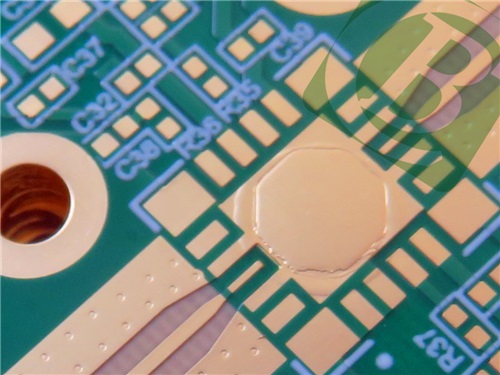

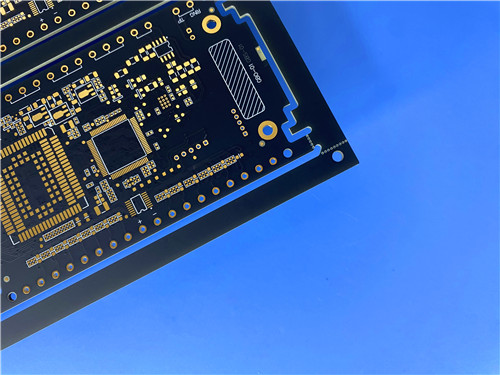

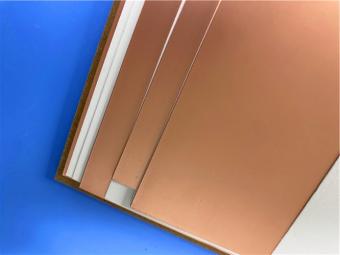

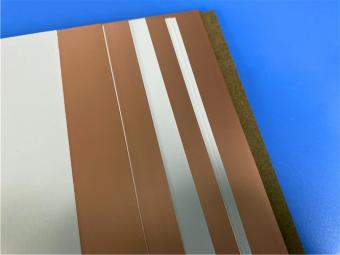

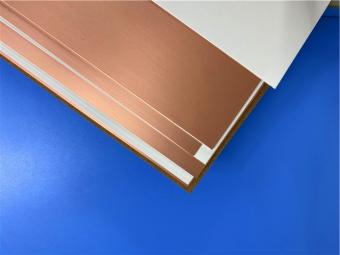

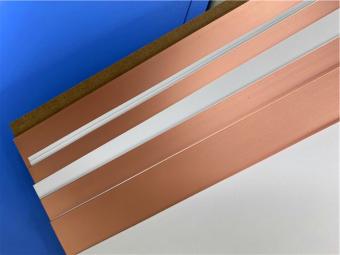

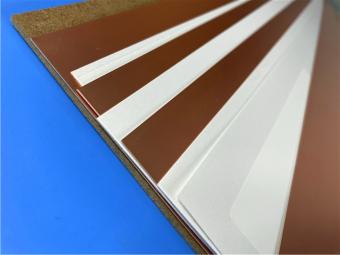

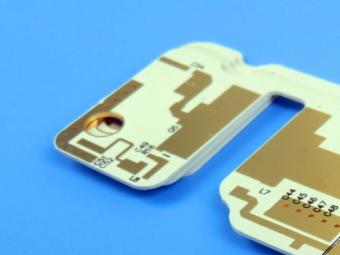

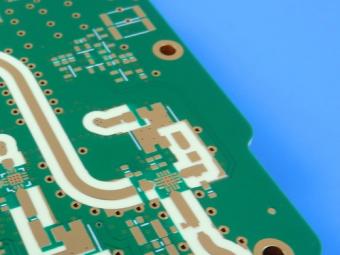

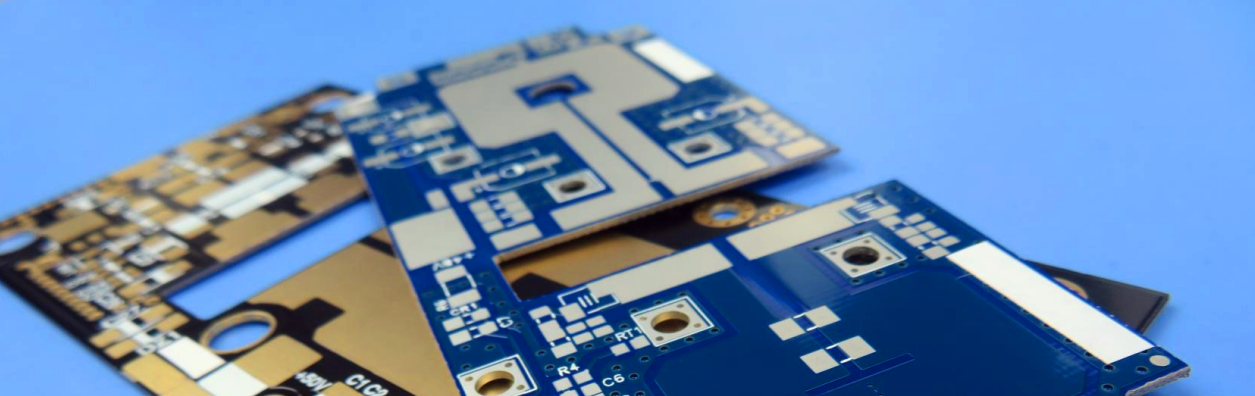

Current Status of the High-Frequency Copper Clad Laminate Industry Overview High-frequency copper clad laminates (HF CCLs) refer to plate-like materials made by impregnating reinforcing materials (such as glass fiber cloth, paper base, etc.) with resin, covering one or both sides with copper foil, and pressing them after heating. They are specifically used in the manufacturing of high-frequency PCBs. Currently, China's HF CCL industry is in a stage of rapid development. As a core basic material in fields such as 5G base station construction, unmanned driving millimeter-wave radar, and satellite navigation, its market demand continues to grow. In the 5G communication field, HF CCLs, with their excellent low dielectric constant (Dk) and low dissipation factor (Df) properties, have become key materials for base station antennas and radio frequency modules, supporting the high-frequency and high-speed transmission requirements of 5G networks. With the accelerated construction of 5G base stations and significantly improved coverage density, the market scale of HF CCLs continues to expand. Meanwhile, the rapid popularization of new energy vehicles has further driven industry growth. Automotive electronic components such as vehicle controllers, motor controllers, and battery management systems have seen a surge in demand for high-performance PCBs. HF CCLs, with their advantages of heat resistance and low loss, have become an important choice for the upgrading of automotive electronics. In addition, under the trend of intelligence, the mature implementation of autonomous driving technology has opened up new application scenarios for HF CCLs. Data shows that the market scale of China's HF CCL industry grew from RMB 950 million in 2017 to RMB 4.334 billion in 2024, with a compound annual growth rate (CAGR) of 24.21%. In the future, with the in-depth coverage of 5G networks and the increase in the penetration rate of new energy vehicles, the HF CCL industry will usher in broad development space. Related Listed Companies Shengyi Technology (600183), Zhongying Technology (300936), Huazheng New Materials (603186), Jin'anguoji (002636), Nanya New Materials (688519), Baoding Technology (002552), Tongguan Copper Foil (301217), Honghe Technology (603256), Dongfang Shenghong (000301), Lanxiao Technology (300487), etc. Related Enterprises Guangdong Longyu New Materials Co., Ltd., Jiangsu Yaohong Electronics Co., Ltd., Jiangxi Pusheng Electronic Technology Co., Ltd., Shenzhen Nafluor Technology Co., Ltd., etc. Keywords High-frequency copper clad laminate, market scale, copper clad laminate, copper foil, output, production capacity, 5G base station I. Overview of the High-Frequency Copper Clad Laminate Industry Copper clad laminates (CCLs) are core substrates used in the manufacturing of printed circuit boards (PCBs) in the electronics industry. They mainly play the roles of interconnection conduction, insulation, and support for PCBs, and have a significant impa...

Call Us Now !

Tel : +86 755 27374946

Call Us Now !

Tel : +86 755 27374946

Order Online Now !

Email : info@bichengpcb.com

Order Online Now !

Email : info@bichengpcb.com